SMM Alumina Morning Comment on July 8

Futures Market: Overnight, the most-traded alumina 2509 futures contract opened at 3,039 yuan/mt in the night session, with a high of 3,049 yuan/mt, a low of 3,015 yuan/mt, and closed at 3,033 yuan/mt, down 9 yuan/mt or 0.30%, with open interest at 263,000 lots.

Ore: As of July 7, the SMM imported bauxite index stood at $74.3/mt, unchanged from the previous trading day; the SMM Guinea bauxite CIF average price was $74/mt, unchanged from the previous trading day; the SMM Australia low-temperature bauxite CIF average price was $70/mt, unchanged from the previous trading day; and the SMM Australia high-temperature bauxite CIF average price was $61/mt, unchanged from the previous trading day.

Spot-Futures Price Spread Daily Report: According to SMM data, on July 7, the SMM alumina index had a premium of 59 yuan/mt against the latest transaction price of the most-traded contract at 11:30 a.m.

Warrant Daily Report: On July 7, the total registered volume of alumina warrants decreased by 2,702 mt from the previous trading day to 18,600 mt. The total registered volume of alumina warrants in Shandong remained unchanged at 0 mt from the previous trading day, in Henan remained unchanged at 0 mt from the previous trading day, in Guangxi decreased by 2,702 mt to 1,200 mt, in Gansu remained unchanged at 0 mt from the previous trading day, and in Xinjiang remained unchanged at 17,400 mt from the previous trading day.

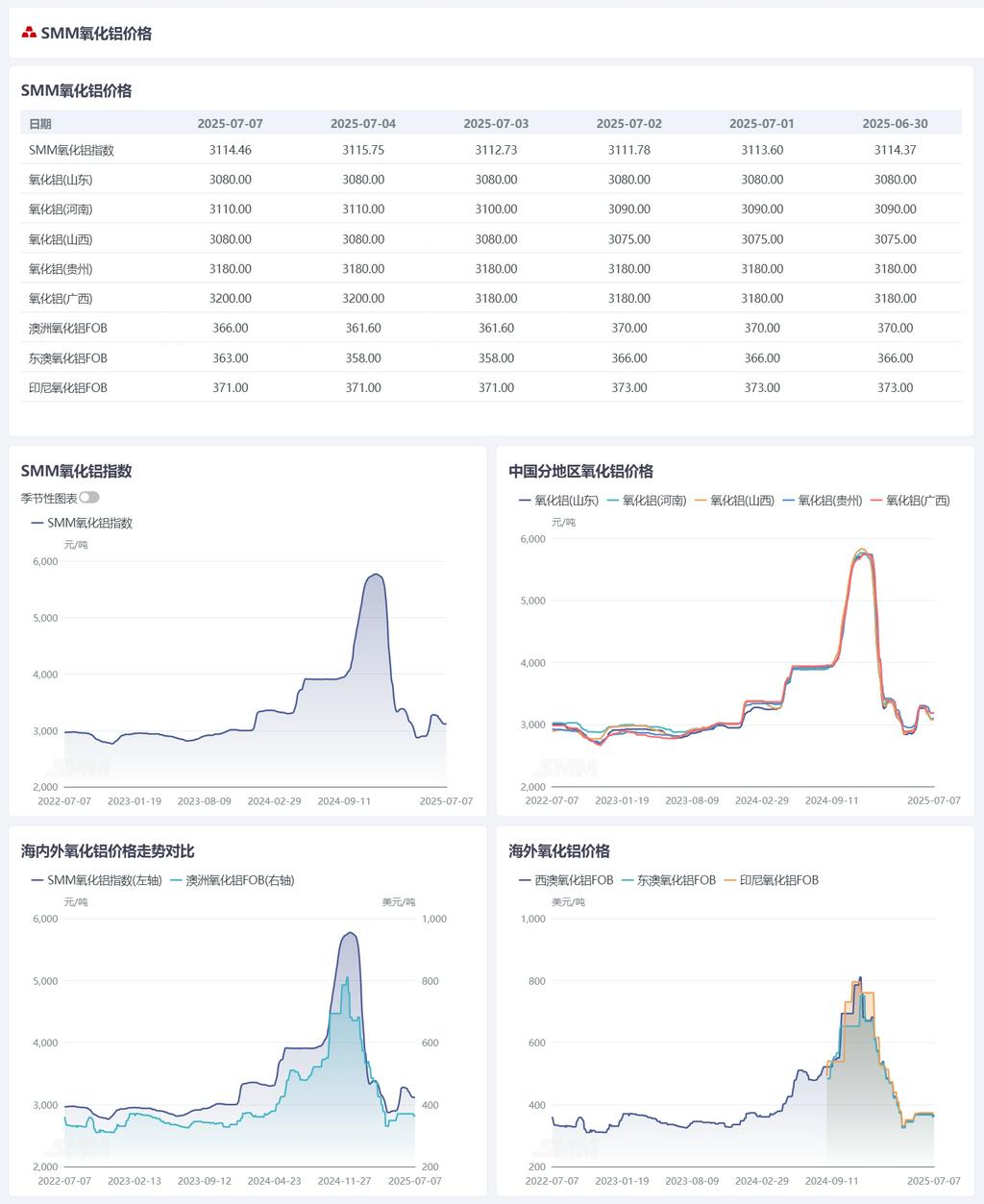

Overseas Market: As of July 7, 2025, the FOB Western Australia alumina price was $366/mt, with an ocean freight rate of $21.80/mt, and the USD/CNY selling rate was around 7.19. This price translates to an external selling price of approximately 3,231 yuan/mt at major domestic ports, which is 116.30 yuan/mt higher than the domestic alumina price, keeping the alumina import window closed.

Summary:

Last week, the operating capacity of alumina decreased by 340,000 mt/year to 88.63 million mt/year. In the short term, the operating capacity of alumina is expected to remain high, with only a few manufacturers conducting routine maintenance. The supply in the spot market remains relatively loose, exerting downward pressure on spot alumina prices. However, with the recent rally in alumina futures, the risk-free arbitrage window between alumina futures and spot is approaching opening, leading to relatively active inquiries from futures-to-spot traders. Spot supplies have tightened temporarily, and suppliers have raised their quotes. In the short term, spot alumina prices may experience a slight rebound. However, the subsequent trend still needs to be monitored for changes in supply and demand fundamentals, futures prices, and transfer to delivery warehouse demand.

[The information provided is for reference only. This article does not constitute direct advice for investment research and decision-making. Clients should make cautious decisions and should not replace their own independent judgment with this. Any decisions made by clients are not related to SMM.】